All Concerning Coverage a Foreign Present: Crucial Steps and Lawful Factors to consider

Reporting international presents entails a complicated collection of rules and policies that organizations have to navigate carefully. Recognizing the specific limits and called for documents is important for compliance. Failure to comply with these criteria can cause substantial fines. As companies progressively get global payments, the relevance of grasping these legal considerations ends up being critical. What are the prospective repercussions of non-compliance, and exactly how can entities properly handle their international present reporting responsibilities?

Comprehending International Presents and Their Ramifications

Foreign gifts, commonly considered as tokens of a good reputation, can lug substantial ramifications for receivers, especially within scholastic and governmental institutions. These gifts, which might include economic donations, scholarships, or product support, can affect the recipient's relationships with foreign entities and federal governments. The nature of the present commonly elevates concerns relating to autonomy and possible disputes of rate of interest.

When approving foreign presents, organizations should navigate the complicated landscape of lawful requirements and moral considerations. The inspirations behind these presents can vary, with some meant to foster cooperation and others possibly intended at advancing details political or ideological agendas.

Reporting Thresholds for Foreign Gifts

Reporting limits for foreign gifts are crucial for guaranteeing conformity with monetary coverage needs. Understanding the meaning of an international gift aids clarify what requires to be reported and under what circumstances. This section will outline the suitable coverage limits that companies must follow when obtaining foreign presents.

Definition of International Presents

Presents obtained from outside the country are categorized as international gifts and can have particular ramifications for recipients. An international present typically refers to any type of product of value-- money, tangible residential or commercial property, or services-- given by a foreign entity or individual. The definition includes presents from international federal governments, firms, or people, and the nature of the gift can vary widely. Notably, the worth of these gifts may go through reporting requirements depending upon established thresholds. Comprehending the difference between international and residential presents is crucial, as it affects the recipient's commitments and prospective tax ramifications. Recipients should remain cautious relating to the source and value of gifts to guarantee conformity with relevant policies connected to international gifts.

Financial Reporting Requirements

Applicable Reporting Thresholds

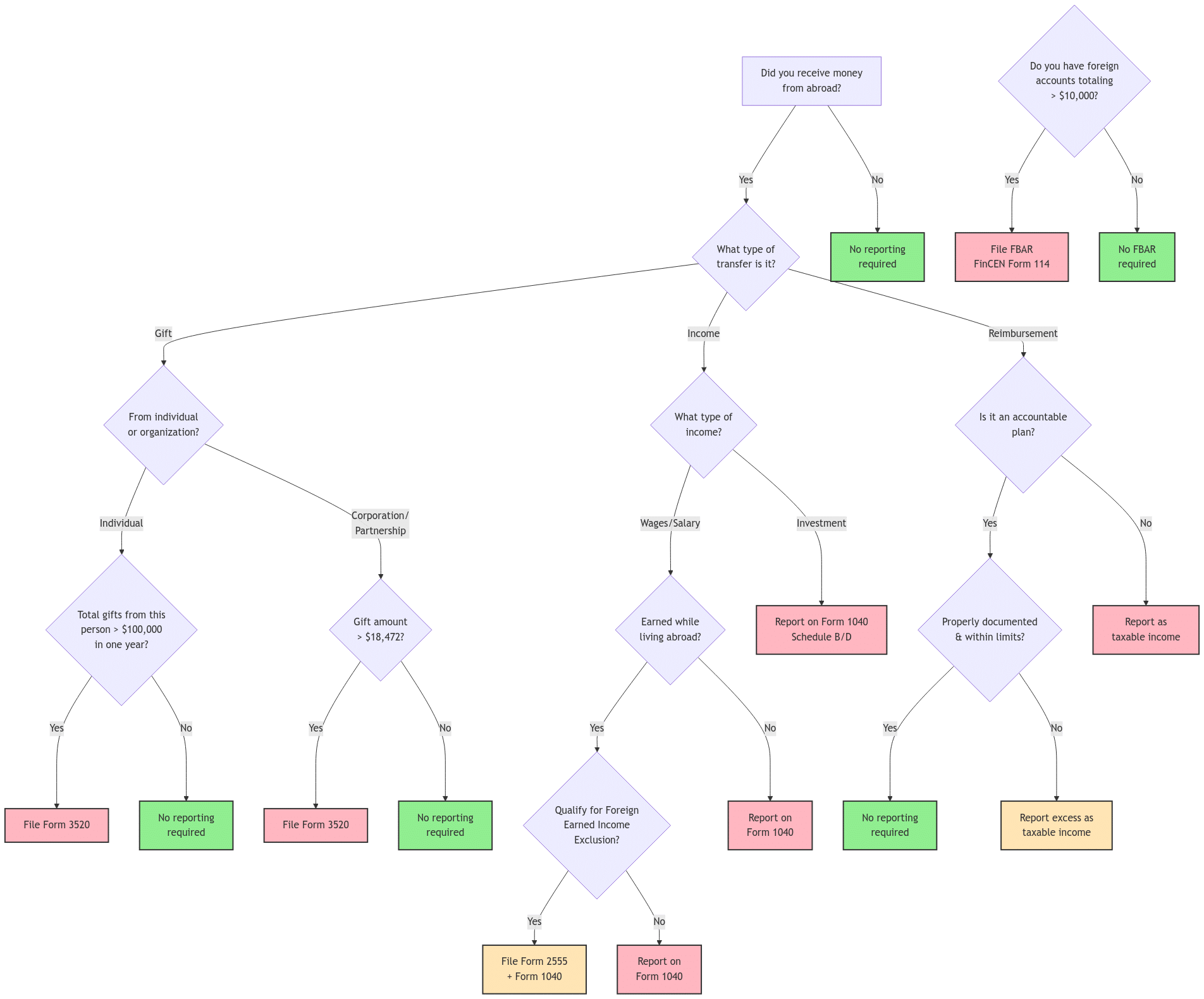

Understanding relevant reporting thresholds for foreign gifts is crucial for compliance with monetary guidelines. Usually, the United State Internal Profits Solution (IRS) mandates that any type of foreign gift exceeding $100,000 should be reported by people. For entities, the limit is reduced, at $10,000. These thresholds put on gifts gotten from international people or companies and include money, property, and other properties. Failure to report presents that surpass these limitations may lead to charges, including fines. It is important for recipients to keep accurate records and guarantee timely submission of necessary forms, such as Form 3520 for individuals. Recognition of these limits assists prevent unintended offenses and advertises transparency in financial ventures with international sources.

Called For Types for Reporting Foreign Present

Conformity with policies bordering foreign gifts is essential for organizations receiving such payments. To guarantee correct reporting, institutions have to use specific types mandated by the united state Division of Education And Learning. The main type needed is the "International Gift Coverage Type," which catches important information regarding the present, including the benefactor's identity, the quantity, and the function of the present. Organizations must likewise give context relating to exactly how the funds will be utilized within the company.

Furthermore, if the present exceeds the reporting limit, it is necessary to report it within the defined time framework, typically within 60 days of receipt. Establishments may additionally require to preserve thorough paperwork to sustain the information presented in the types. Failing to complete the necessary kinds accurately can lead to charges and impede the institution's capacity to accept future foreign payments. Adherence to these requirements is crucial for lawful compliance and institutional integrity.

Tax Considerations for Receivers of International Presents

While foreign presents can provide significant financial backing for establishments, they also come with particular tax obligation implications that recipients should navigate. The Irs (INTERNAL REVENUE SERVICE) mandates that any U.S. person receiving foreign gifts surpassing a certain limit must report these presents on Kind 3520. This reporting is vital to prevent charges and assurance compliance with U.S. tax obligation laws.

Receivers need to realize that while obtaining an international gift is normally ruled out taxable income, the reporting need still uses. Furthermore, the tax implications might differ depending upon the nature of the present, whether it is financial or property. International presents can likewise impact the recipient's inheritance tax obligation if they are considerable. As an outcome, it is a good idea for recipients to consult tax professionals to recognize their responsibilities fully and to ensure proper reporting and conformity with all relevant guidelines.

Consequences of Falling Short to Report Foreign Present

Stopping working to report foreign presents can lead to considerable consequences for recipients, as the Irs (IRS) enforces strict charges for non-compliance. Recipients might face significant financial effects, including fines that can rise to 25% of the unreported gift's worth. Additionally, the internal revenue service retains the authority to impose rate of interest on any unsettled tax obligations connected with the international present, moreover aggravating the financial problem. Non-compliance can additionally set off audits, leading to a lot more comprehensive examination of the recipient's economic activities. In severe situations, individuals might be subjected to criminal fees for unyielding forget in reporting, bring about prospective jail time. Failing to abide could harm one's integrity and reputation, influencing future web financial opportunities and relationships. In general, the relevance of adhering to reporting requirements can not be overstated, as the implications of overlooking this responsibility can be significant and damaging.

Finest Practices for Conformity and Record-Keeping

Efficient compliance and record-keeping are crucial for managing international presents. Organizations should concentrate on maintaining exact paperwork, establishing clear reporting procedures, and conducting normal conformity audits. These ideal techniques assist ensure adherence to policies and reduce potential risks related to foreign contributions.

Maintain Accurate Documentation

Exact documents is necessary for organizations receiving international presents, as it ensures compliance with institutional plans and legal needs. Preserving extensive documents includes documenting the information of the present, including the donor's identification, the quantity or value of the present, and any type of problems connected to it. Organizations ought to additionally track the day of receipt and the objective for which the gift is planned. It is a good idea to categorize gifts based upon their nature, such as cash money, home, or services, making certain that all appropriate papers, such as communications and arrangements, are stored firmly. Regular audits of paperwork can better enhance compliance efforts, aiding to determine any kind of discrepancies and making certain that the organization is planned for potential queries or reporting commitments.

Establish Clear Reporting Procedures

Developing clear coverage procedures is necessary for organizations to ensure compliance with laws surrounding international presents. These treatments ought to outline that is in charge of reporting, the particular info called for, and the deadlines for submission. It is important to develop an organized process that includes training for personnel on recognizing and reporting international presents accurately. Organizations ought to likewise assign a conformity officer to supervise the coverage procedure and work as a factor of get in touch with for questions. Additionally, executing a centralized system for monitoring and recording foreign gifts can boost openness and accountability. By establishing these procedures, organizations can lessen the threat of non-compliance and guarantee they meet all lawful demands successfully.

Normal Compliance Audits

Regular compliance audits are a necessary element of preserving adherence to international gift policies. These audits help organizations ensure that all received gifts are accurately reported and recorded in accordance with lawful demands. Finest techniques for conducting these audits consist of developing a clear timetable, engaging certified personnel, and using thorough checklists that cover all pertinent reporting requirements. Organizations need to likewise preserve in-depth paperwork, including document associated to international presents and documents of previous audits. Constant training for staff associated with reporting procedures can boost understanding and compliance. Furthermore, carrying out restorative action strategies for recognized disparities can enhance adherence to regulations and minimize prospective legal threats. Routine audits foster a society of transparency and accountability in handling foreign gifts.

Frequently Asked Concerns

Can I Report a Foreign Present Anonymously?

Reporting an international gift anonymously is typically not possible, as guidelines typically call for identification of the benefactor. Transparency is emphasized to ensure compliance with legal requirements and to minimize potential risks connected with undisclosed foreign payments.

What if My International Gift Is a Loan Instead?

If the international gift is a funding, it should be reported in different ways. Car loans commonly involve repayment terms and may not drop under the exact same coverage requirements as gifts, requiring mindful see this website testimonial of suitable regulations.

Are Foreign Presents Obtained by Minors Reportable?

International gifts obtained by minors are generally reportable, similar to those gotten by grownups. report a foreign gift. The commitment to report relies on the gift's worth and the certain policies regulating international presents within the recipient's territory

Just How Can I Prove the Source of a Foreign Present?

To show the source of a foreign gift, one should obtain paperwork such as bank statements, present letters, or agreements. This proof assists establish the beginning and legitimacy of the funds or things received.

Can Foreign Gifts Influence My Migration Status?

Foreign gifts generally do not impact immigration status straight; nonetheless, considerable gifts may question throughout visa applications or testimonials. It is crucial to ensure compliance with pertinent guidelines to prevent prospective problems.

Many people and companies should stick to certain monetary reporting needs when getting foreign presents, especially when these presents surpass established limits. The main form called for is the "Foreign Present Reporting Kind," which captures essential details concerning the gift, consisting of the contributor's identification, the quantity, and the purpose of the present. The Internal Profits Service (IRS) mandates that any U.S. individual obtaining foreign presents exceeding a specific limit should report these gifts on Kind 3520. To show the resource of a foreign present, one should acquire documentation such as financial institution statements, present letters, or agreements. Foreign presents generally do not effect immigration condition straight; however, considerable presents may increase inquiries during my site visa applications or testimonials.